|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring Accident Only Pet Insurance: A Comprehensive GuideIn recent years, the burgeoning industry of pet insurance has seen a notable rise in popularity, especially among devoted pet owners who are keen on safeguarding their furry companions. Among the myriad of options available, accident only pet insurance stands out as a distinct choice, offering a unique blend of affordability and essential coverage. This type of insurance is specifically tailored for pet owners who wish to ensure their pets are protected against unforeseen accidents without the additional cost of illness coverage. In a world where veterinary expenses can skyrocket unexpectedly, such an option provides a much-needed financial cushion, offering peace of mind to those who prioritize their pets’ wellbeing. Accident only pet insurance covers a range of incidents such as fractures, cuts, ingestion of foreign objects, and poisoning. However, it does not extend to illnesses or hereditary conditions, which some pet owners might find limiting. Nevertheless, for those whose primary concern is accident-related injuries, this type of policy can be a perfect fit. When comparing accident only pet insurance policies, several factors must be taken into account to ensure that the chosen policy aligns with the needs of both the pet and the owner. Some of the most popular options in the market include providers like Petplan, Trupanion, and Healthy Paws, each offering distinctive benefits and coverage limits. Petplan is well-regarded for its comprehensive accident coverage, which includes alternative therapies and behavioral treatments, a rare find in the realm of accident only insurance. Their policies are also notable for having no upper age limit, making them a viable option for older pets who are more prone to accidents. On the other hand, Trupanion offers a straightforward plan with a consistent 90% reimbursement rate and no payout limits, providing clarity and predictability for pet owners. This can be particularly appealing for those who prefer a no-nonsense approach to insurance. Meanwhile, Healthy Paws is often praised for its user-friendly mobile app that simplifies the claim process, allowing pet owners to focus more on the care of their pets rather than bureaucratic hurdles. While each provider has its unique strengths, there are certain universal factors that should be considered when selecting an accident only pet insurance policy. These include the deductible amount, reimbursement percentage, and annual coverage limits. A lower deductible might be advantageous for those who expect to make frequent claims, whereas a higher deductible could reduce monthly premiums for those who foresee fewer accidents. The reimbursement percentage is crucial as it determines how much of the veterinary bill will be covered by the insurer, affecting the out-of-pocket expenses for the pet owner. Additionally, annual coverage limits should be scrutinized to ensure they align with potential veterinary costs, particularly in the case of severe accidents. It's also important to note the subtle nuances and fine print that accompany these policies. For instance, some insurers may have waiting periods before coverage kicks in, or exclusions for specific breeds known for certain accidents. Therefore, a thorough examination of the policy details is imperative to avoid any unexpected surprises when a claim is made. Ultimately, the decision to opt for accident only pet insurance hinges on the pet owner’s assessment of their pet’s lifestyle and potential risks. Active pets who frequently engage in outdoor adventures might benefit significantly from such coverage, as would owners who are keen on mitigating the financial impact of sudden accidents. In conclusion, while accident only pet insurance might not cover every possible scenario, its affordability and targeted protection make it a compelling option for many pet owners. By carefully evaluating the available options and considering both the pet’s needs and the owner’s financial situation, one can make an informed decision that balances cost with peace of mind, ensuring that our beloved pets receive the care they deserve in times of unexpected adversity. https://www.reddit.com/r/petinsurancereviews/comments/1gf71s7/accident_only_pet_insurance_recommendation/

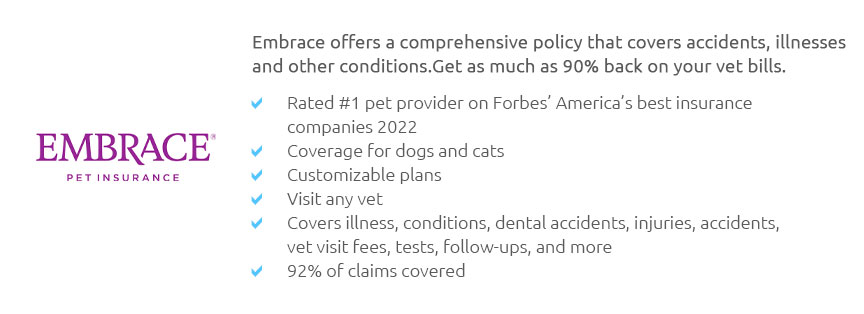

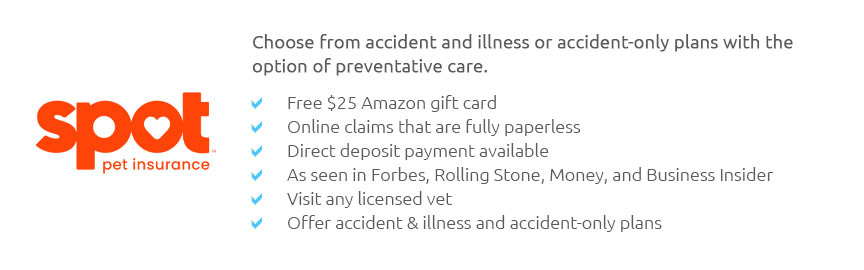

I believe ASPCA, Spot, Embrace, Pets Best, AKC offer it. You could get some quotes and see what they offer in your zip code. https://spotpet.com/accident

Accident only pet insurance plans generally do not cover the cost of treatment for illnesses, as it is ... https://www.petpartners.com/our-plans/accident-only

The CompanionSelect pet insurance plan available for older dogs and cats and will reimburse on veterinarian bills for covered accidents and injuries.

|